Introduction

At a recent conference for finance professionals, nearly one-third of the breakout sessions had the word “AI” in their title. They ranged from strategic discussions on AI, as one of the megatrends or part of the latest industrial revolution, stories about using AI to generate amazingly accurate and inaccurate forecasts to real-time demos on using ChatGPT and CoPilot as productivity tools.

Compared to the discussions that took place at last year’s conference, this year’s topics and content were much more practical and realistic, with a lot more real-life examples of how companies are using AI-powered solutions to make their processes more efficient. There were many discussions about projects where AI failed to add value and caused unforeseen disruptions.

When it comes to integrating AI technology into business processes, the question isn’t if you’ll start the journey—it’s when and how, much like the adoption of the internet in the 1990s. Today, finance professionals view AI with a blend of excitement, apprehension, and caution, much as the business world initially approached the internet. As with the internet, AI is set to transform every aspect of our personal and professional lives. However, not everyone is enthusiastic about this shift, and many companies are still bracing for the challenges of yet another disruptive technology.

AI at the Forefront of Finance: Key Themes from Recent Conferences

Here are some examples of AI-related discussions:

- A group of AI visionaries clearly mapped out the path of AI-powered predictive analytics. Some companies in the audience have already started moving towards getting their processes and data ready for faster and more accurate sales and revenue forecasting.

- A major fintech company shared its experience in how its current processes have improved with the help of AI. Their finance team was able to use AI tools to turn days of work in data reconciliation into hours or even minutes, which translates to a reduction of 80%+ effort and results in far fewer errors than manual reconciliation.

- A group of finance, i.e., non-technical, presenters demonstrated how to use ChatGPT to generate code that can dissect, reconcile, and analyze financial data. It showed that as long as one had clear knowledge and expectations of input and output, AI technology could be utilized without users understanding the intricacies of programming.

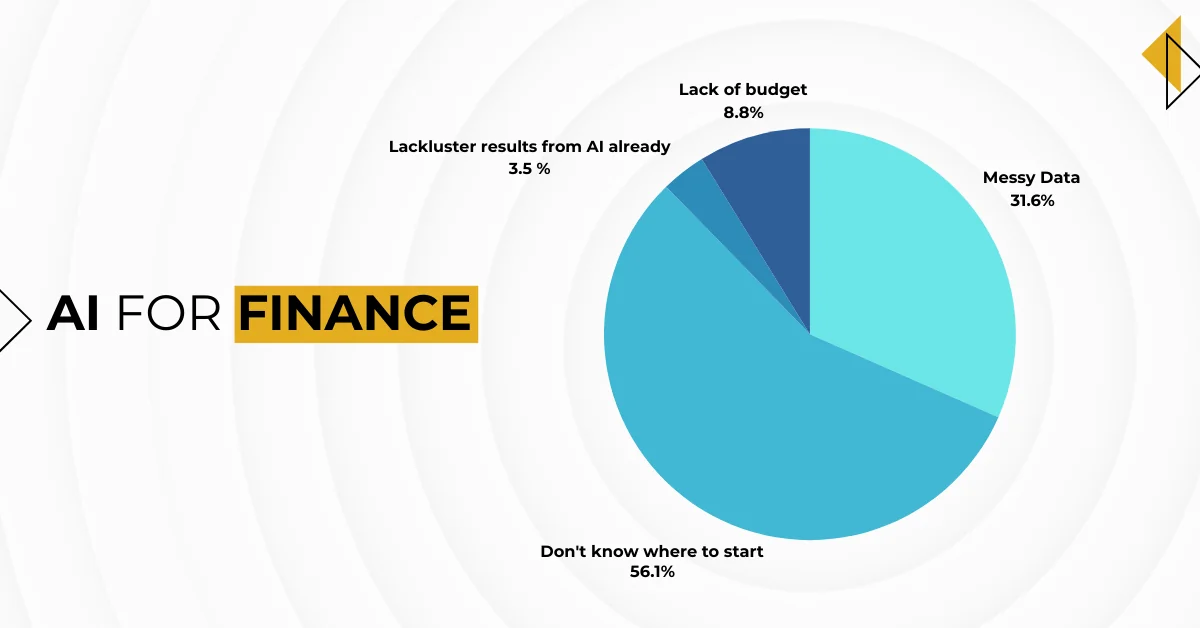

- Most interestingly, when a real-time survey was conducted during a presentation about AI for Finance, more than half of the audience indicated they didn’t know where to start with deploying AI for Finance. That explains why many AI sessions were completely packed.

Interested to learn about the increasing importance of AI in decision-making? Read our recent blog, 5 Ways to Improve Decision-Making with AI.

AI-Powered Innovations on Display: Finance Software Solutions

Beyond the breakout sessions, many established finance software companies in the exhibit hall are now showcasing AI-driven features through live demos. These capabilities range from AP and AR automation to smart dashboards, KPIs, narrative analytics, and dynamic forecasting. While these solutions are impressive and innovative, these companies also emphasize that AI’s emergence doesn’t lessen the need for robust business processes and effective data management strategies. History has repeatedly shown that major technological advancements demand careful planning and rigorous execution of business fundamentals. The more streamlined your processes are and the more accurate and accessible your data is, the better positioned your company will be to fully leverage AI

If you are the decision maker for your business, this blog will bridge that gap for you and will provide you with actionable tips to make AI a major stakeholder in your business operations.

Essential Preparations for a Successful AI Transformation

There are certainly many well-known challenges when it comes to adopting AI for Finance, such as the amount of investment, maturity of the current tools, the readiness of the staff, data security, etc.. Still, it’s never too early to start preparing your systems, processes, and data for the eventual transformation. Here are some important reminders:

- Just like any data-driven technology, AI is also “garbage in, garbage out.” Take some time to ensure your ERP, CRM, and HCM transaction data is up-to-date, contains all necessary granularities in retrievable formats, and that your financial statements are accurate. NetSuite users, for example, may deploy NetSuite Analytics Warehouse first to ensure data integrity and completeness, then deploy prebuilt or custom AI models for predictive analytics.

- As most companies have more than one business software system, ensure that integration between the systems is near real-time or as frequent as your company needs. It’s even better to have a data lake that pulls all data together in a structured manner. Microsoft Fabric is a good example of such architecture, where Microsoft CoPilot can easily utilize data to enable AI functionalities.

Bonus read: All new with Microsoft Copilot

- Instead of asking, “What can AI do for me?” a better question is, “What are my top priority issues, and are there any AI-powered tools that can help address them?” AI is only part of the answer, for it must be considered along with process improvement, user training, organization adoption, and constant return-on-investment analysis.

- A keynote speaker at the conference, Malcolm Gladwell, once said that a tipping point occurs at the accumulation of small changes. In the same manner, do not try to make a giant leap forward when adopting AI technology. Take baby steps in various areas, allow plenty of time and investment to test and pilot different tools, and always keep an open mind for adjusting along the way.

Is Your Finance Team Ready for AI? Consult with AlphaBOLD to Find Out!

From predictive analytics to automated data checks, AI is reshaping finance. AlphaBOLD can help you assess your current systems, prepare your data, and strategize for seamless AI integration. Book a consultation to discover how you can modernize your finance operations for maximum efficiency and insight.

Request a ConsultationAlphaBOLD: Your Partner in Data Management and AI-Ready Finance Solutions

Companies, including yours, will sooner or later need to incorporate AI technology in their business processes. If you would like to consult experts in data management to come up with a data lake strategy, need assistance with ensuring your data is flowing through multiple systems accurately and efficiently, or simply want to do a health check on your ERP or CRM data, be sure to engage a business solution consulting firm like AlphaBOLD. When you’re ready to explore AI in finance, AlphaBOLD can guide you with tailored strategies in data management, system integration, and AI adoption. We will help you take your finance organization to the next level and transform it into a strategic advantage for your company.

Take Your Finance Operations to the Next Level with AI—Consult with AlphaBOLD

Whether you’re looking to improve forecasting or automate reporting, AlphaBOLD offers AI consulting services tailored for finance. Our experts can guide you in building an AI strategy that aligns with your goals and optimizes your finance processes.

Request a ConsultationExplore Recent Blog Posts