Table of Contents

Introduction

The banking industry is undergoing rapid transformation. As competition intensifies and customer expectations evolve, financial institutions must rethink how they engage with customers, manage risk, and ensure regulatory compliance. Yet, many banks still struggle to leverage their data effectively. Over half fail to utilize AI-driven analytics to enhance customer loyalty and streamline operations.

AI in banking is reshaping financial services by providing real-time insights, improving fraud detection, and delivering hyper-personalized customer experiences. From risk management to seamless omnichannel interactions, AI enables banks to stay competitive while meeting regulatory demands. This blog explores the benefits, risks, and emerging use cases of AI in banking for 2025, offering insights into how financial institutions can harness AI for long-term growth and resilience.

AI in Banking: Addressing Industry Challenges Through Innovation

Adapting to New Technologies:

Banks must continually adapt to new technologies, and customer demands to stay ahead. AI-powered solutions help financial institutions:

- Introduce new products and services that align with evolving customer needs.

- Automate processes to reduce operational costs and improve efficiency.

- Expand into fintech and emerging markets by leveraging AI-driven insights for strategic growth.

With AI, banks can accelerate decision-making, personalize services, and enhance operational agility, positioning themselves for long-term success.

Strengthening Risk, Security, and Compliance:

Regulatory requirements in banking are becoming more stringent, requiring institutions to invest in advanced compliance and reporting solutions. AI assists by:

- Automating regulatory reporting to ensure compliance with evolving financial regulations.

- Enhancing fraud detection with machine learning models that identify suspicious transactions in real time.

- Improving cybersecurity by analyzing threats and preventing fraud before it occurs.

With Generative AI for banks, institutions can strengthen risk management by detecting fraud patterns faster, reducing compliance costs, and ensuring regulatory adherence without manual inefficiencies. McKinsey estimates that generative AI could add between $200 billion and $340 billion in value annually to the banking sector.

Further reading: Top Generative AI Trends Shaping 2025

Meeting Customer Expectations with AI-Powered Personalization:

Customers today expect seamless, hyper-personalized banking experiences across multiple channels. AI enables banks to:

- Deliver personalized financial recommendations based on customer behavior and transaction history.

- Empower employees with data-driven insights to improve customer interactions.

- Ensure 24/7 customer engagement through conversational AI chatbots for banks, which streamline support while maintaining a human-like experience.

A data-driven, AI-powered approach allows banks to build deeper customer relationships while providing consistent, high-quality service across digital and human-led channels.

Microsoft’s Intelligent Data Platform for the Banking Industry

Banks today generate massive amounts of data, yet many struggle with siloed systems, outdated technology, and inefficient analytics. Without a unified approach to data, decision-making slows, security risks increase, and operational costs rise.

Microsoft’s Intelligent Data Platform provides a scalable, AI-powered solution that helps banks centralize data, enhance risk management, and accelerate innovation. By integrating AI into banks, financial institutions can streamline compliance, improve fraud detection, and deliver data-driven customer experiences at scale.

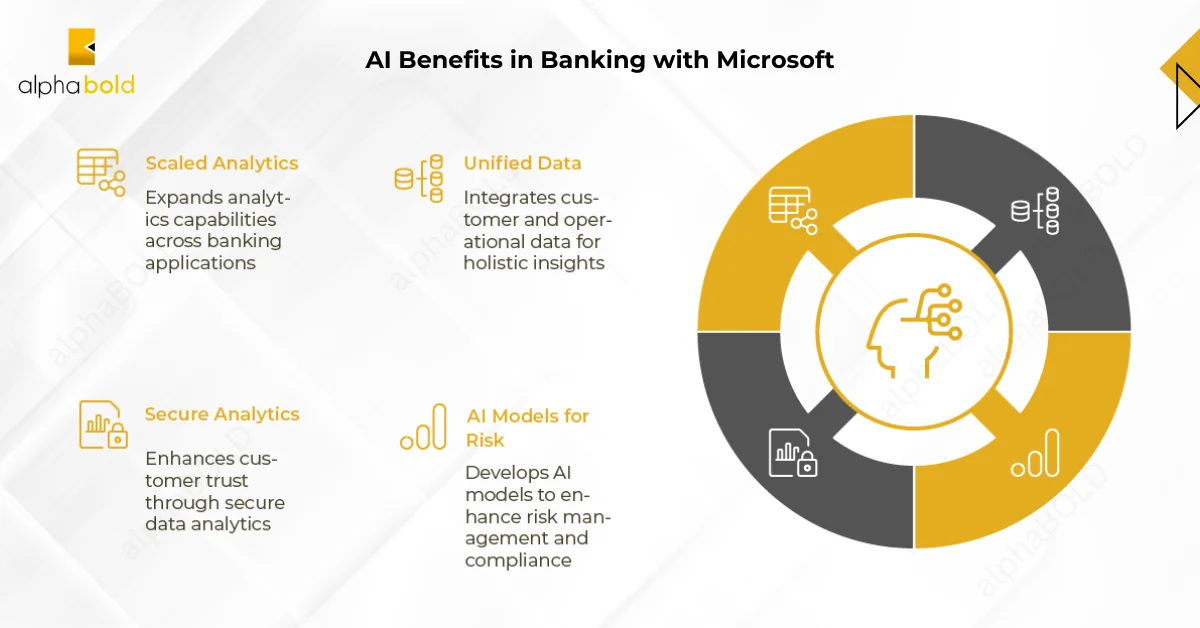

Key Benefits of AI in Banking with Microsoft:

- Unify Customer and Operational Data: Eliminate data silos by centralizing financial, customer, and operations data within a single, governed platform. Gain real-time visibility into customer trends, transactions, and risk factors.

- Build AI Models for Risk and Compliance: Strengthen AI for investment banking with models that analyze capital reports, predict credit risk, and detect fraud in real time—reducing compliance costs and improving security.

- Enhance Customer Trust with Secure Analytics: With Generative AI for banks, financial institutions can provide conversational AI for banking, improving customer service while ensuring strict security and data governance measures.

- Scale Analytics Across Banking Applications: Equip teams with AI-powered insights to enhance decision-making, optimize branch operations, and improve mobile banking experiences with AI chatbot for banks and automated workflows.

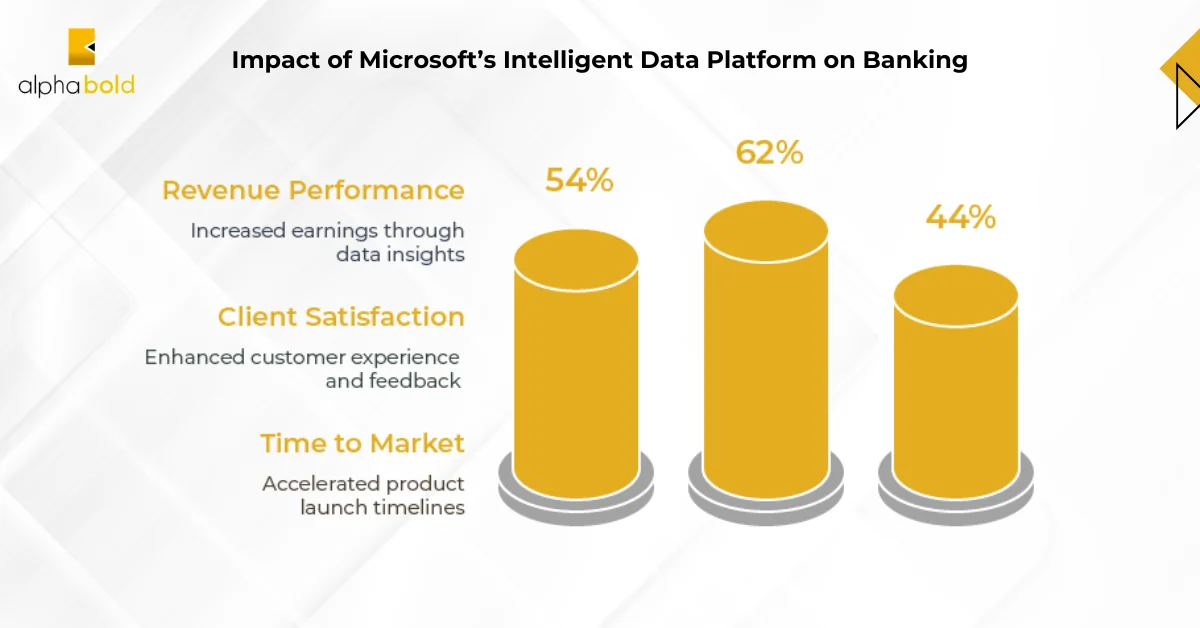

Real-World Impact: Proven Results

Banks leveraging Microsoft’s Intelligent Data Platform have reported:

- 54% increase in revenue performance

- 62% improvement in client satisfaction

- 44% faster time to market

By adopting AI-driven analytics, banks can reduce costs, enhance customer experiences, and strengthen financial resilience. Microsoft’s AI solutions ensure banks remain competitive as the industry moves toward intelligent, real-time decision-making.

By adopting AI-driven analytics, banks can reduce costs, enhance customer experiences, and strengthen financial resilience. Microsoft’s AI solutions ensure banks remain competitive as the industry moves toward intelligent, real-time decision-making.

Ready to Explore Microsoft’s AI Solutions?

Build a seamless data ecosystem and leverage Microsoft’s AI platform to turn insights into action—empowering smarter decisions and sustainable growth. Start your transformation today!

Get Expert ConsultationAI in Banking: Real-World Use Cases

1. Fraud Detection and Risk Management:

AI models analyze transaction patterns in real-time to identify fraudulent activity, reducing financial losses and strengthening compliance. Banks using Azure Cognitive Services and Machine Learning enhance fraud detection by integrating multiple data sources, improving accuracy, and automating risk assessments. AI-powered fraud detection systems help financial institutions proactively mitigate threats before they impact customers.

2. AI-Powered Credit Scoring and Loan Approvals:

Traditional credit risk models rely on limited historical data, leading to inefficiencies. AI for investment banking enhances credit scoring by incorporating real-time transaction history, behavioral insights, and external economic indicators. With Azure Machine Learning, banks automate lending decisions, reducing manual verification and accelerating approvals while maintaining regulatory compliance.

3. Conversational AI for Banking and Customer Support:

AI-driven chatbots and virtual assistants are transforming customer interactions. Conversational AI for banking enables 24/7 automated customer service, handling routine inquiries, fraud alerts, and financial recommendations. AI chatbot for banks powered by Azure AI enhances personalization, improves response times, and ensures seamless omnichannel banking experiences.

4. AI-Driven Investment Insights and Market Predictions:

Investment firms rely on Generative AI for banks to analyze vast datasets, detect market trends, and generate predictive financial models. AI-driven analytics improve risk assessment, automate financial reporting, and provide data-backed investment strategies. Using Azure Synapse Analytics, institutions process large volumes of financial data efficiently, allowing real-time decision-making for portfolio management.

Read more: AI in Finance – Fantasy or Reality?

5. Data Unification for Smarter Decision-Making:

Financial institutions often struggle with siloed data across legacy systems. Microsoft’s Intelligent Data Platform provides a centralized hub, integrating Azure Data Lake, Synapse Analytics, and Purview to streamline data governance. By unifying data sources, banks improve analytics efficiency, enhance risk visibility, and gain actionable insights that drive operational performance.

Scaling AI in Banking for the Future

By integrating AI for banks, financial institutions enhance fraud prevention, improve customer engagement, and optimize decision-making. Microsoft's AI-powered data solutions enable banks to reduce costs, scale AI adoption, and create a more intelligent, agile financial ecosystem.

Get Expert ConsultationMitigating AI Risks in Banking with AlphaBOLD

While AI has multiple use cases and benefits in banking, it also comes with risks such as data security challenges, regulatory compliance issues, algorithmic bias, and operational disruptions. These risks can slow adoption and impact financial stability without a structured approach.

AlphaBOLD, a Microsoft consulting partner, helps banks deploy AI securely and efficiently by:

- Ensuring Compliance – Implementing AI solutions aligned with financial regulations and governance standards.

- Enhancing Security – Using Microsoft Purview and Azure Data Lake to protect sensitive banking data.

- Optimizing AI for Banks – Streamlining operations with AI for investment banking, fraud detection, and predictive analytics.

- Reducing Implementation Risks – Delivering scalable AI strategies tailored for banking needs.

Conclusion

AI in banking is driving efficiency, security, and smarter decision-making. Financial institutions that adopt AI reduce fraud, improve compliance, and enhance customer engagement. With Microsoft’s Intelligent Data Platform, banks can unify data, automate processes, and scale AI-driven insights.

However, AI adoption comes with risks. AlphaBOLD helps banks deploy AI securely, ensuring compliance, data protection, and operational efficiency. From fraud detection to AI for investment banking, we deliver scalable, risk-free AI solutions tailored for the financial sector.

Take the Next Step with AI

With AlphaBOLD, banks can confidently adopt AI, ensuring security, compliance, and operational efficiency. Let’s discuss how we can support your AI initiatives.

Request a ConsultationExplore Recent Blog Posts